Promotion of Responsible Investment

We have established “ESG Investment and Financing Policy” and “Policies for Fulfilling Stewardship Responsibilities” as the fundamental principles of “responsible investment,” which is driven by both ESG investments and stewardship activities. This clarifies our commitment to act appropriately as a responsible institutional investor, while aiming to create a sustainable and hopeful society.

In April 2020, we established "Responsible Investment Office" as a specialized department for responsible investment, and in April 2024, we reorganized this office into "Responsible Investment Development Department" to strengthen our efforts in promoting and further advancing responsible investment initiatives.

Additionally, in July 2021, we set targets for reducing CO2 emissions to contribute to the creation of a sustainable society. We aim to transfer to an investment portfolio that supports the realization of a decarbonized society, while paying attention to alignment with the goals of the Paris Agreement.

Responsible Investment Report

We have disclosed the "Responsible Investment Report" to communicate our initiatives related to responsible investment to our stakeholders.

Responsible Investment Report 2024(PDF 14.9MB)

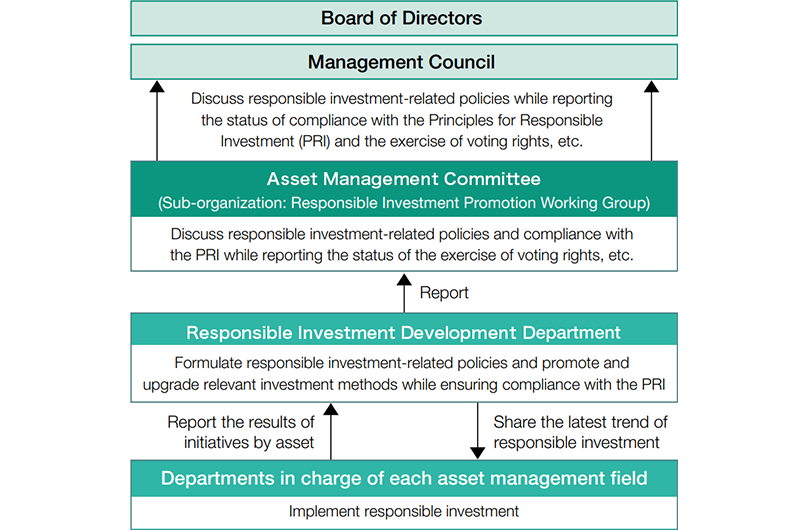

Our Structure for Promoting Responsible Investment

The Responsible Investment Development Department plays a central role in formulating policies for and upgrading initiatives related to ESG investment and financing as well as dialogue with investees.

In addition, this department provides business units in charge of each asset management field with updates on the latest trends of responsible investment while delivering reports on accomplishments and progress Meiji Yasuda has made in this area to key committees and meeting bodies.

The content of these reports is verified by committees, the Management Council and the Board of Directors in order to appropriately operate a PDCA cycle to promote Companywide initiatives.

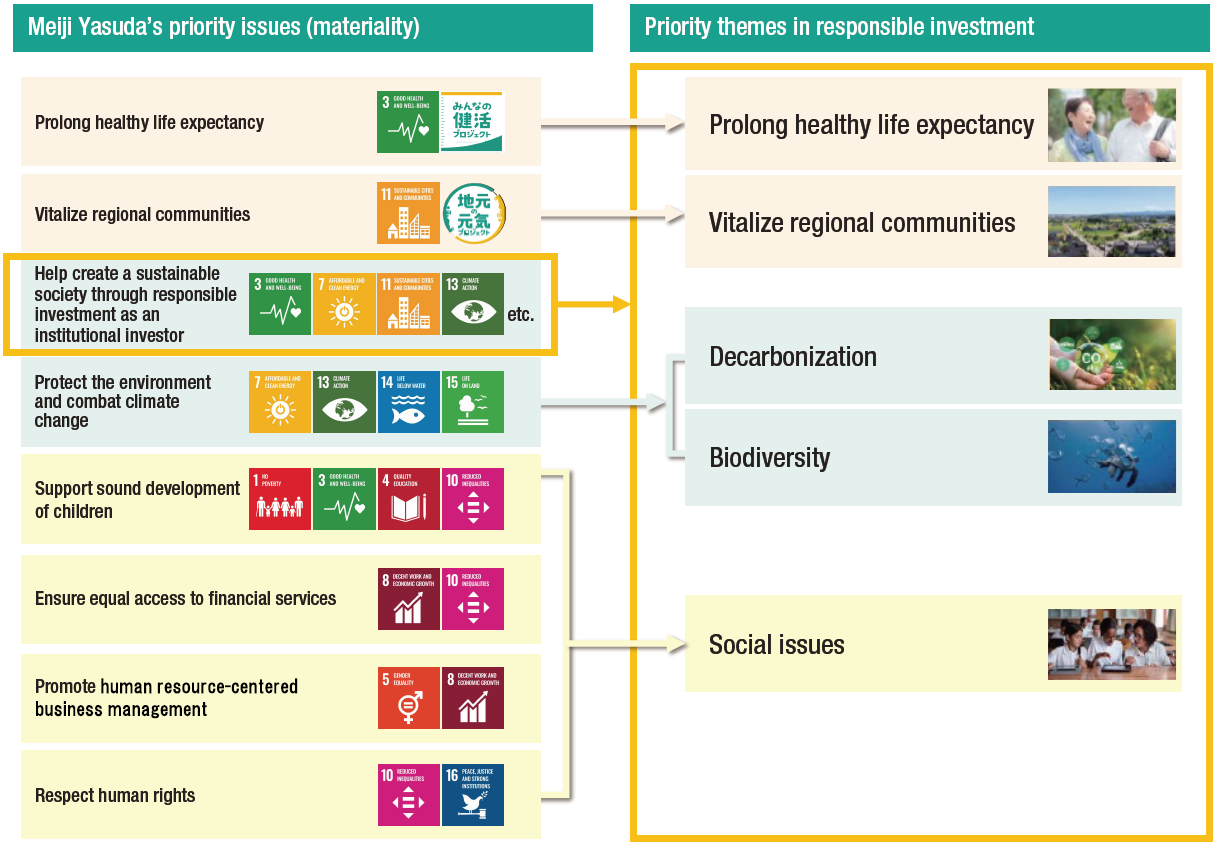

Priority themes for responsible investment

In FY2024, we incorporated our goal to “Help create a sustainable society through responsible investment as an institutional investor” in the list of priority issues (materiality) after reviewing such issues by taking into account their impact on stakeholders and their relevance to our business activities. Our responsible investment is thus aimed at addressing the following five priority themes defined based on this goal.

Correspondence to Climate Change Risks

As a responsible institutional investor, we are promoting initiatives to contribute to the realization of a decarbonized society through asset management. In July 2021, we set targets for reducing CO2 emissions. While ensuring alignment with the goals of the Paris Agreement, we aim to transfer to a portfolio that contributes to the realization of a decarbonized society. In addition to investing and financing in green bonds and renewable energy generation projects, we are actively engaging in transition finance and other initiatives.

Furthermore, when dealing with high CO2 emitters among our investees, we are promoting initiatives toward decarbonization by not only engaging in activities on our own, but also collaborating with other investors, while understanding the transition plans such as coal-fired power projects. We are also requesting engagement activities to be carried out by our outsourced operators.

Main Initiatives

- Confirm the content of investees’ plans for reducing CO2 emissions and encourage investees to promote decarbonization (reduce CO2 emissions) via engagement

- Promoting ESG investments to create economic and social Value

- Incorporating ESG perspectives into all assets under our management to establish optimal methods for ESG investment in light of asset characteristics

- Publicize the details of each investment and otherwise enhance the content of information disclosure associated with ESG investment

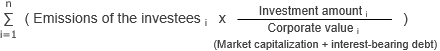

Initiatives to Reduce CO2 Emissions in Investment and Financing Portfolios

Targets and ResultsDetailed Data

|

FY2023 Result |

FY2030 Target |

FY2050 Target |

|

|---|---|---|---|

|

Emissions |

-49% |

-50% |

-100% |

|

Intensity*3,4 |

-40% |

-49% |

-100% |

*1 Total emissions

*2 Representing reduction targets for Scope 1 & 2 emissions from domestic listed companies we invest in via stock, corporate bonds and other financing

*3 Total emissions/ investment amount, an indicator that can reflect the company's actual reduction performance without being affected by the size or change of the investment and financing volume

*4 Target assets: Stock, corporate bonds and other financing of domestic and foreign listed companies, and real estate(investment purpose)

ESG Investment and Financing Policy

Under our management philosophy of “Peace of mind, forever,” and with a focus on contributing to the achievement of the SDGs (Sustainable Development Goals), we ensure the profitability of our asset management to maximize returns for policyholders, while concentrating on global environmental and social challenges and revitalizing domestic regional economies through ESG investment and financing. As a responsible institutional investor, we manage assets to fulfill our social responsibilities to stakeholders and our public mission, aiming to build a sustainable and hopeful society.

ESG Investment and Financing Policy(PDF 94.4KB)

Basic Concept of Transition Finance(PDF 102KB)

Integration of ESG Factors and Tasks

At Meiji Yasuda, we promote implementing ESG factors (disclosed information related to ESG and ESG ratings etc.) on investment decisions in listed stock, bonds and other financing, etc, depending on the characteristics of the asset.

Similarly, during our engagement conversation with our investees, we aim to increase the investees’ corporate values by confirming each of their ESG subjects and give encouragement towards solving them in accordance to necessity.

|

E |

|

|---|---|

|

S |

|

|

G |

|

In addition with outsourced investment, we confirm the policies of ESG and ESG integration, engagement, and information disclosure condition etc. and we implement it in our investment decision process while considering each investee’s investment strategies and asset characteristics.

ESG Investment and Financing Methods

We promote ESG investment and financing methods defined as below.

|

ESG Investment and Financing Methods |

Definition | |

|---|---|---|

|

ESG Theme-type Investment |

An investment with themes in which contributes to the solving of ESG subjects | |

|

ESG Bond |

Green bond, Social bond, Sustainability bond etc. | |

|

Impact-investing |

An investment that will bring positive impact to society and environment. | |

|

Real estate |

Real-estate investment, equipment renovation, real-estate equity and REIT investment etc. with care on ESG | |

|

Other |

Project financing of renewable energy related projects, facility investment etc. | |

|

ESG Integration |

Systematic integration of ESG factors into the investment process. | |

|

Positive Screening |

Select industries and companies that are making relatively high attempts to ESG ratings and ESG. | |

【Negative Screening】

In consideration of the public nature of the life insurance business, our company subjects the following investments and loans to negative screening.

|

Theme |

Area |

Screening Target Sectors |

Target Assets |

|---|---|---|---|

|

Climate Change |

Fossil Fuels |

|

|

|

Biomass Fuel |

|

||

|

Human Rights |

|||

|

Inhumane |

|

|

* Key Transition Criteria Defined by Our Company

- Eligible assets include bonds issued by the Japanese government or local public entities, loans and corporate bonds for domestic companies, domestic project finance, and domestic non-recourse loans.

- Companies and projects must meet the standards set by the International Capital Market Association (ICMA) "Climate Transition Finance Handbook" and the Ministry of Economy, Trade and Industry's "Basic Guidelines on Climate Transition Finance" (including sector-specific technology roadmaps).

- For coal, oil, and gas-related projects, both new and renewed, they must have CO2 emission reduction measures such as CCUS, with expected lifecycle CO2 emission reductions, and measures to avoid carbon lock-in.

- Transition criteria are subject to review in accordance with revisions of various laws, regulations, and guidelines.

In addition, we don't have upstream oil project exposure.

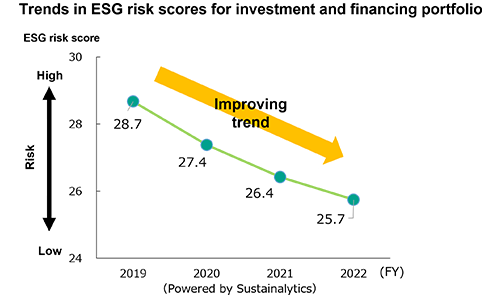

As a result of screening using ESG ratings and promoting dialogue with investees for the purpose of resolving ESG issues, ESG risks*1 in our investment and financing portfolio are improving.

*1 A score is set as the absolute value of “unmanaged risk” that is the difference after subtracting the amount of risk that the company has managed from the amount of risk related to the company’s ESG issues. ESG risk scores for investment and financing portfolios are calculated by taking the weighted average of the ESG risk scores of each investee by the investment and financing amount.

Promotion of ESG Investment and Financing

During the current medium-term management plan period (FY2024-2026), we will continue to promote ESG investments and financing, while actively setting target amounts for "impact finance," which aims to create positive impacts on society and the environment. For "impact finance," we executed approximately 84 billion yen FY2024 and raised the target amount for the current medium-term management plan from the previous 120 billion yen to 170 billion yen.

Additionally, we have set a target amount of 600 billion yen for financing that contributes to decarbonization from FY2021 to FY2026, and by the end of FY2024, we executed approximately 870 billion yen. We will continue to promote financing that contributes to decarbonization in the future.

|

Targets for |

|||

|---|---|---|---|

|

Results for FY2024 |

|||

|

ESG investment and financing amount |

800 billion yen |

about 600 billion yen |

|

|

Funds extended in impact finance |

170 billion yen |

about 84 billion yen |

|

Stewardship Activities

We have adopted the Principles for Responsible Institutional Investors, known as the Japan’s Stewardship Code.

In our equity investments, we have established a "Policies for Fulfilling Our Stewardship Responsibilities" to guide our stewardship activities, which include engaging in dialogue with investee companies and exercising voting rights.

Through these activities, we aim to enhance the corporate value of our investee companies and thereby enjoy long-term and stable benefits as shareholders.

Furthermore, as bondholders, we have been engaging in dialogue with domestic bond issuers since the fiscal year 2020.

Policies for Fulfilling Our Stewardship Responsibilities(PDF 129KB)

Participating in initiatives

Meiji Yasuda has become a signatory to domestic and international initiatives, with the purpose of developing global networks and utilizing external insight to constantly upgrade its mode of responsible investment.

List of Participated Initiatives

External Evaluation

PRI Annual Evaluation

In November 2024, we received the evaluation from PRI for our activity report for the year 2023 (covering the period from January to December 2023).

We earned the highest rating of five-stars in its two applicable categories for the second consecutive year.

|

Category |

Details |

Ratings |

|---|---|---|

|

Policy, Governance and Strategy |

Policy, governance and strategy related to responsible investment and stewardship activities |

★★★★★ |

|

Confidence-building measures |

Reporting items and data verification |

★★★★★ |